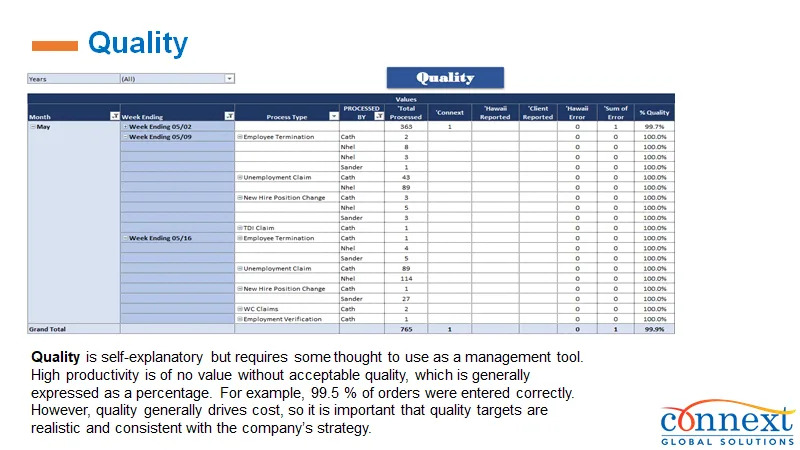

Certified Excellence

Our unwavering commitment to quality

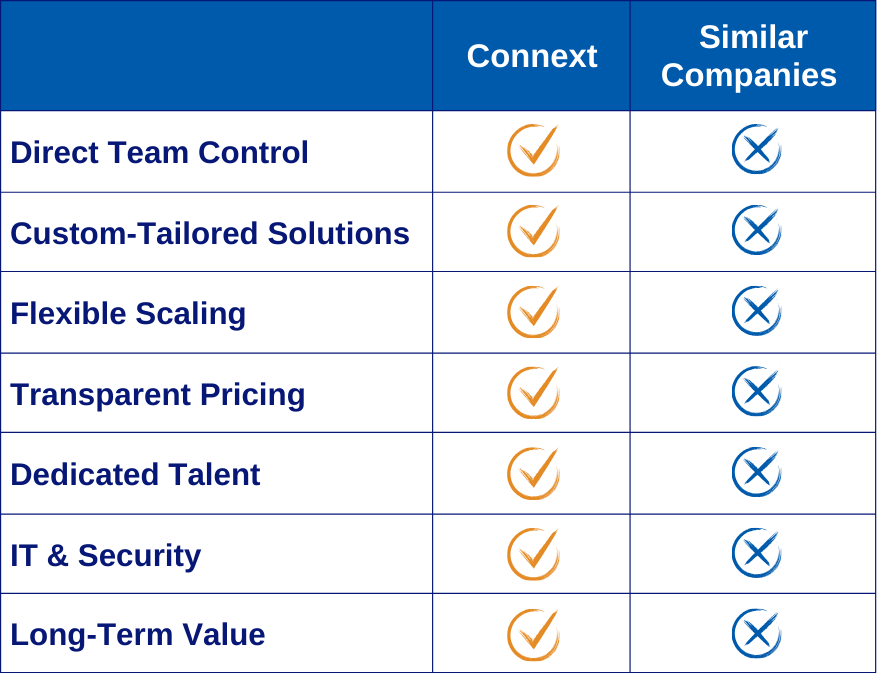

The Connext Advantage

Don’t settle for outdated BPO models from similar companies. Partner with Connext for a smarter, more efficient outsourcing experience.

Discover the Roles We Fill

Find out how Connext can upscale your business

Find out how Connext can upscale your business

Full-Time Staff Expenses

Transparent & Flexible Pricing

Our pricing model is designed with you in mind. Enjoy the flexibility of month-to-month contracts and no upfront payments—meaning you can scale your team as needed without locking into long-term commitments. Our transparent pricing guarantees you know exactly what you’re investing in, eliminating surprises and empowering you with full budgetary control.

Trusted by 200+ Companies

“We have enjoyed working with Connext and have developed a deep relationship with the company.”

Neil Tagawa

CEO, RedHammer LLC

“The truth is Connext is just THAT awesome and the Filipino staff are unmatched in dedication, language proficiency, hard work, and respect.”

Ernest Sutton, CPA

Vice President, RediCarpet

“I liked the leadership, flexibility, and commitment to retaining people with a profoundly human touch.”

COO

Fintech Company

“Connext has truly listened to our needs.”

VP of Strategy & Corporate Development

Software Company

“We’ve found the provided resources to be very high quality and wonderful to work with.”

Jamie Wiseman

Principal, Real Estate Development Firm

“Connext’s services in providing our business with a talented employee were unmatched. We have worked with four different outsourcing companies and no one can perform to the level of Connext.”

Senior Business Strategist

Transportation Company

“Our overall experience with Connext has been great….From interviews, to training and continuous improvement, they have been supportive and always listen to our needs.”

Chief Operating Officer

Construction Company

“Incredible Service, Affordable Price = Great Relationship And Value”

SVP Operations

Software Company

“The Connext team is extremely helpful in securing exceptional talent for roles we needed support filling. The staffing has been a game-changer for our practice.”

Practice Manager

Services (non-Government)

“Highly recommend Connext and their team!”

Chief Executive Officer

Media Company

“Working with Genavie from the Connext team has been great—everyone loves collaborating with her. It’s one of the key reasons our expansion conversation is happening. Connext is the best ‘Google search’ I’ve ever done!”

Managing Director

Investment Firm

“I’ve worked with several accounting support teams in the Philippines at my previous workplace, and I can wholeheartedly say that you folks are the best I’ve ever worked with. Thank you for all you do for us!”

Alison Inafuku

Accounting Manager, Tony Hawaii Automotive Group